From today Wednesday the 1st October 2014, the paper tax disc will no longer need to be displayed on a vehicle.

From today Wednesday the 1st October 2014, the paper tax disc will no longer need to be displayed on a vehicle.

If you haven’t heard or have not been reading our updates on the ending of the paper vehicle tax disc after 93 years, then this article will be new news.

Two of the most frequent questions we have heard in the run up to the changes are:

If I have a tax disc with any months left to run after the 1st October this date, then it can be removed from the vehicle?

The answer to that is yes and it can be destroyed or perhaps you might want to tuck it away for posterity.

This is also applicable to us in Northern Ireland, however were required you will still have to display a MoT disc.

The other is about refunds and now will those be applied.

The answer to that is included below with some other information on the change or you can watch the video below or head to the government websites.

Good luck with the new system, we are off out to the garage to remove the tax disc and its holder that clutters up the front end of a perfectly good looking motorcycle!

Sourced from the vehicle tax changes webpage and NI Direct Government Services

To drive or keep a vehicle on the road you will still need to get vehicle tax – for those that need to pay you will still need to pay for vehicle tax – no getting out of that one!

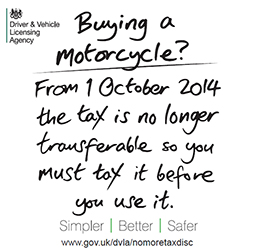

Now when you buy a vehicle, the vehicle tax will no longer be transferred with the vehicle.

You will need to get your new vehicle taxed before you can use it.

There are various means to tax a vehicle – on-line – by phone – at your local post office – in Northern Ireland you’ll also need an insurance certificate or cover note.

DVLA (Driver & Vehicle Licensing Agency) in Swansea (remember all our vehicle tax offices were closed down and responsibility moved to the DVLA in GB) can’t check vehicle insurance details for new keepers in Northern Ireland online or by phone so you will need to get your new vehicle taxed at a post office which deals with vehicle tax.

If you sell a vehicle after 1st October and you have notified DVLA, you will automatically get a refund for any full remaining months left on the vehicle tax. The refund will be sent to the keepers details on DVLA records so you need to make sure that these are correct.

If you don’t use or keep your vehicle on a public road (eg you keep it in a garage, on a drive or on private land) you can make a Statutory Off Road Notification (SORN) on-line as well now.

DVLA have informed the European Union that from 1 October 2014, UK registered vehicles that are travelling in the EU will not display tax discs.

From 1st October 2014 (5th October if setting up at a Post Office®), Direct Debit will be offered as an additional way to pay for vehicle tax. This will be available for customers who need to tax their vehicle from 1 November 2014.

We have looked but failed to find if smaller motorcycles – over 150cc and 151-400cc – who can only have taxed purchased for them at the 12 months rate and not for six months will be now be offered direct debit – although at £17 and £38 per year – we would assume not.

The registered keeper on record will be issued with an automatic refund when they notify DVLA that they no longer need to tax the vehicle any longer such as it being sold/transferred or declared off the road (SORN).

Vehicle Tax Changes – GOV.UK – Click Here

Abolition of the Vehicle Tax Disc – NI Direct Government Services – Click Here

Useful Links – GOV.UK

Renew Tax on-line – Click Here

Calculate vehicle tax rates – Click Here

Vehicle tax rate tables – Click Here

Statutory Off Road Notification (SORN) – Click Here

Check the tax status of any vehicle online – Click Here

Post Office branch finder (Post Office website) – Click Here

Speak Your Mind