In yesterdays budget – Wednesday 19th March 2014 – the government increased the amount of road tax – Vehicle Excise Duty (VED) – that road users have to pay.

In yesterdays budget – Wednesday 19th March 2014 – the government increased the amount of road tax – Vehicle Excise Duty (VED) – that road users have to pay.

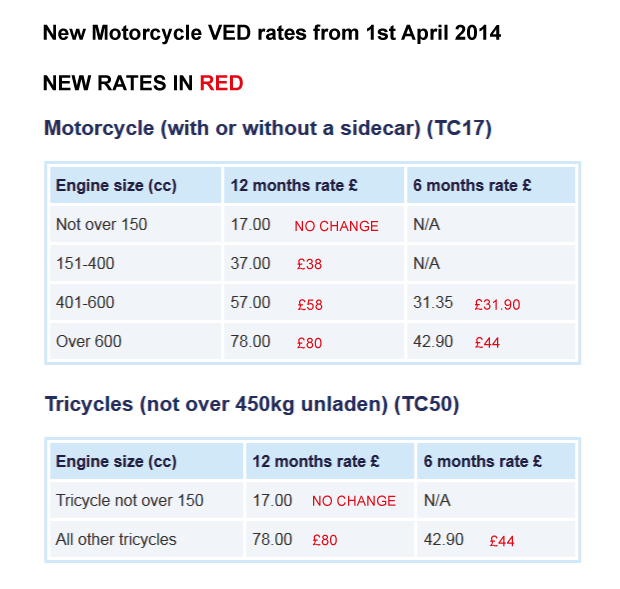

This increase, albeit a small increase included most motorcycles, apart from those under 150cc.

The largest bikes, over 600cc the VED was put from £78 to £80 for 12 months and from £42.90 to £44 for six months road tax.

Not forgetting a previous announcement that from April 2014, vehicles manufactured before January 1974 will join the exemption from the previous VED exemption for vehicles built before 1st January 1973. Combined with that, from later this year we will no longer receive a paper tax disc to fix and exhibit on vehicles as proof that Vehicle Excise Duty (VED) has been paid in respect of your vehicle, it is all change.

In a recent article on Right To Ride we published the governemnt response to an on-line petition calling for motorcycles to be inline with car VED – based on emissions.

“As this e-petition has received more than 10 000 signatures, the relevant Government department have provided the following response:

The decisions of successive Governments have resulted in VED being structured according to vehicle type and registration date with VED contributing to general taxation revenues. Cars registered before March 2001 are taxed according to engine size, and those registered from March 2001 onwards taxed according to carbon dioxide (CO2) emissions.

Unlike for cars, the European Union has not yet established a design type approval test for motorbikes that requires CO2 data to be produced for each model variant. The current scheme for motorbike manufacturers is voluntary and so does not offer a complete dataset for all motorbikes in production. The Government is therefore not in a position to treat motorbikes on a CO2 emissions basis for VED. The current engine capacity based rates offer the most practical and easy-to-understand way to reflect the respective emissions levels of motorbikes.

The majority of motorcycle owners, in fact, pay rates lower than the top VED rate of £78. A third of motorcyclists pay the lowest VED rate applicable to motorcycles, i.e. of £17. The Government believes that healthy public finances are essential for future growth and jobs. The UK is still faced with the serious and unavoidable economic challenge of tackling the debts inherited from the previous Government. Despite this challenge, under this Government, VED rate increases for cars, vans and motorcycles are limited to inflation only, meaning that a motorist’s VED liability remains unchanged in real terms since 2010.

This e-petition remains open to signatures and will be considered for debate by the Backbench Business Committee should it pass the 100 000 signature threshold”

E-petition – Government Response – Click Here

As we said at that time, “Well as previously mentioned this is heading our way so if there is a want in Government to change the system for motorcycles, let’s hope it is a more reasonable structured system specifically for bikes and not based on cars and that government doesn’t see it as a way of increasing VED for motorcycles, as what eventually works out in the example in the petition.”

The reasoning for that was, “Why would we sign a petition that would have us paying up to £175.00 for 12 months tax or £96.25 for 6 months tax when at present for the largest motorcycle we pay at present £78.00 for 12 months and £42.90 for 6 months?”

Now we only have a small increase of a couple of quid……………………. but it is worth watching for proposals to base motorcycle VED on emissions!

Links & Information

VED In-Line Again – Click Here

VED & SORN – Click Here

Outraged At London – Click Here

The Cost Of Vehicle Tax – ni government services – Click Here

Speak Your Mind