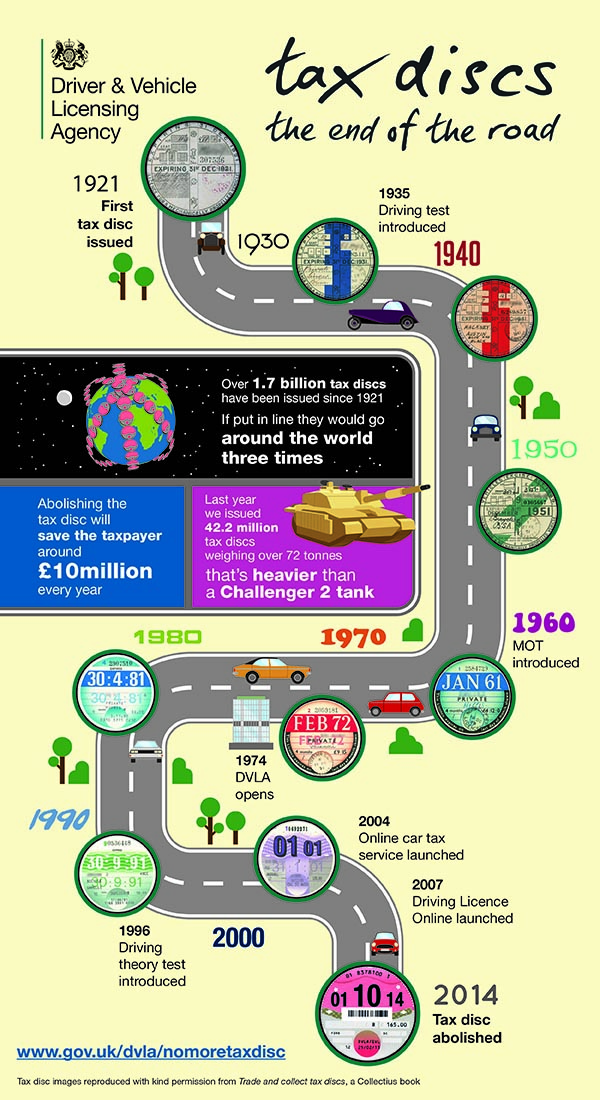

Tax Disc End Of The Road

The DVLA (Driver & Vehicle Licensing Agency) in Swansea, who have now taken over the responsibility for all vehicle licensing services in Northern Ireland, have officially announced the end of the road for the need to display a tax disc.

The DVLA (Driver & Vehicle Licensing Agency) in Swansea, who have now taken over the responsibility for all vehicle licensing services in Northern Ireland, have officially announced the end of the road for the need to display a tax disc.

From the 1st October 2014 the requirement to display the paper tax disc on a motorcycle or vehicle windscreen will end, no paper disc will be issued by DVLA.

In motorcycling terms, this is the end to having to bolt, with the risk of being stolen, tax disc holders to our bikes/trikes, although in Northern Ireland for all vehicles that are required to display a MoT disc you will still need to display the paper disc.

Although the paper disc is being done away with DVLA remind us that, to drive or keep a vehicle on the road you will still need to get vehicle tax and DVLA will still send you a renewal reminder when your vehicle tax is due to expire.

This applies to all types of vehicles including those that are exempt from payment of vehicle tax as these vehicles are still required to be registered within the DVLA system.

So what other changes are taking place from 1st October 2014

If you sell a vehicle after 1st October and you have notified DVLA, you will automatically get a refund for any full calendar months left on the vehicle tax.

If you sell a vehicle after 1st October and you have notified DVLA, you will automatically get a refund for any full calendar months left on the vehicle tax.

Also it will be no longer be possible to transfer the benefit of a vehicle licence (remaining tax) when there is a change of registered keeper.

This means that you cannot leave the tax on the vehicle for the next owner – a good point to clinch a private sale.

From 1st October, when you buy a vehicle, the vehicle tax will no longer be transferred with the vehicle. You will need to get new vehicle tax before you can use the vehicle.

The onus is on the new registered keeper of the vehicle to apply for road tax.

There has been some “outrage” that the government will be able to cash in all the used part month road tax that people can’t claim back.

However the rules at present on refunds are: You cannot get a refund if the tax disc has run out or it has less than one calendar month left on it and maybe to save that couple of quid for yourself is to try and sell the vehicle right at the end of the month!

From 1st October 2014 (5th October if setting up at a Post Office®), Direct Debit will be offered as an additional way to pay for vehicle tax. This will be available for customers who need to tax their vehicle from 1st November 2014 – with a charge for this facility – 5 per cent surcharge will apply to biannual and monthly payments.

You can apply online to tax or SORN your vehicle using your 16 digit reference number from your vehicle tax renewal reminder (V11) or 11 digit reference number from your log book (V5C) this includes from Northern Ireland.

You can check the tax status of any vehicle online This can also be used for rental vehicles.

Full Article and Original Source for Information – Click Here

Owning a Vehicle from nidirect Government services – Click Here

The Sad Goodbye!